Investing in Miami is not just a financial decision; it’s a bet on lifestyle, diversity, and continuous growth. As the CEO of Waallss and an international real estate advisor, I’ve witnessed firsthand how this city has evolved and positioned itself as a true magnet for investors from around the world.

And it’s no wonder.

In 2024, we are seeing a landscape full of possibilities, where both major players and newcomers to the market can find the perfect place to invest.

The numbers speak for themselves. In 2024 alone, single-family home prices increased by 3.8% compared to the previous year.

But don’t get me wrong; investing here is not a game of chance. It’s essential to understand the market dynamics and know exactly where and how to invest to maximize returns.

And this is where my experience and knowledge of the local market come into play. My team at Waallss and I are committed to guiding our clients with concrete data, personalized strategies, and an honest approach.

If you’re ready to discover why Miami could be your next big investment, you’re in the right place.

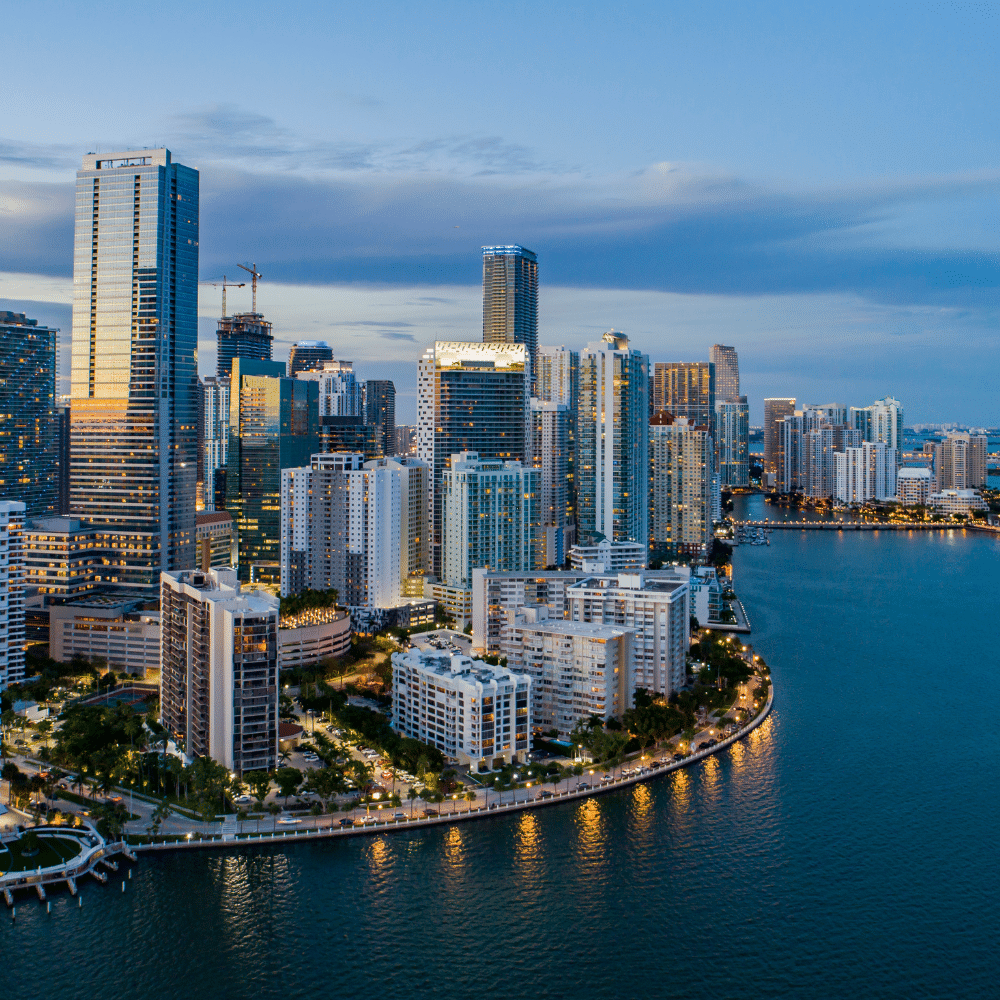

The Miami real estate market has been a constant topic of conversation in the investment world, and for good reason.

In my experience as a real estate advisor, I have seen how this market evolves and adapts to economic and demographic changes. And 2024 is no exception.

To truly understand where the opportunities lie, one must look at the numbers and trends with a critical eye. So, let’s dive in.

First, let’s talk about prices.

Average Property Prices in Miami 2024

The average price of a single-family home in Miami-Dade has reached $415,000 (on average) this year, representing an increase of +3.8% compared to the previous year.

These increases reflect demand from both residents and international investors who see Miami as a safe and profitable haven for their capital.

Drivers of Demand in Miami

So, what is driving this demand?

We are seeing a combination of factors: from population growth and the rising trend of remote work to the perception of Miami as a destination that offers both quality of life and economic opportunities.

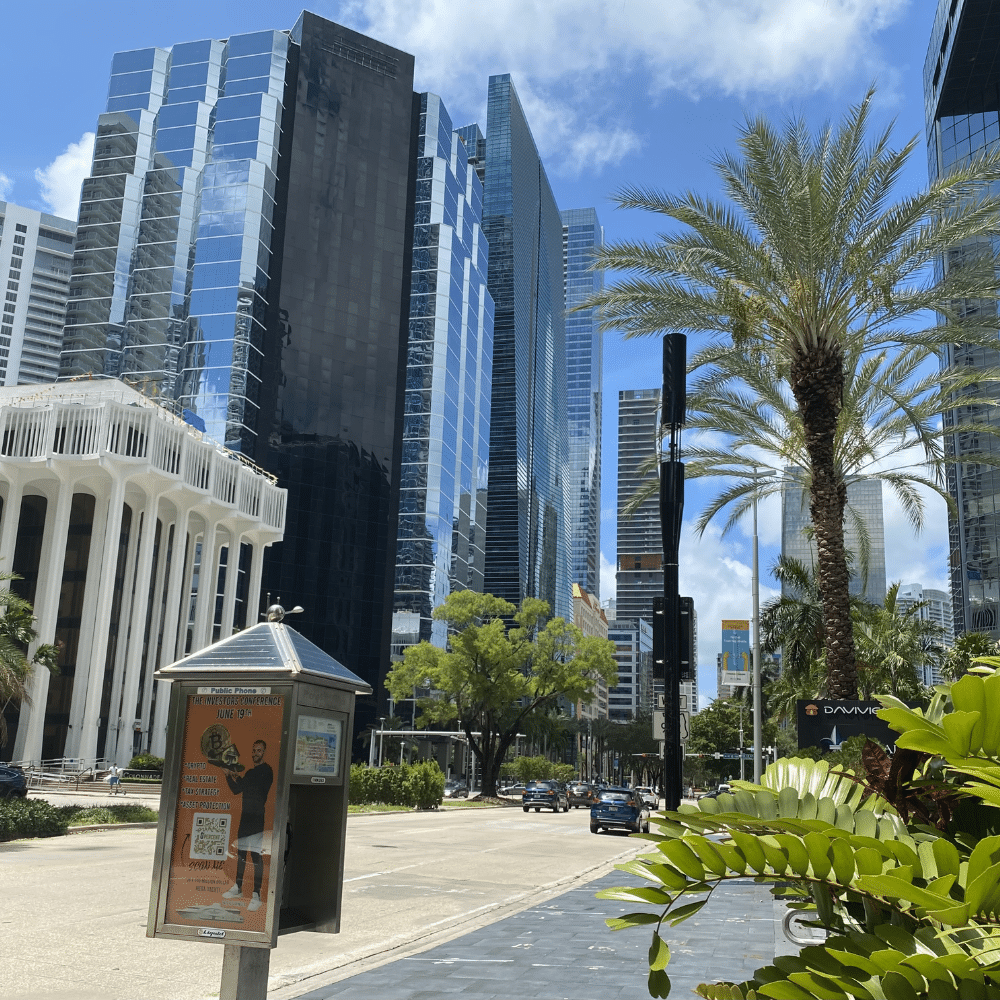

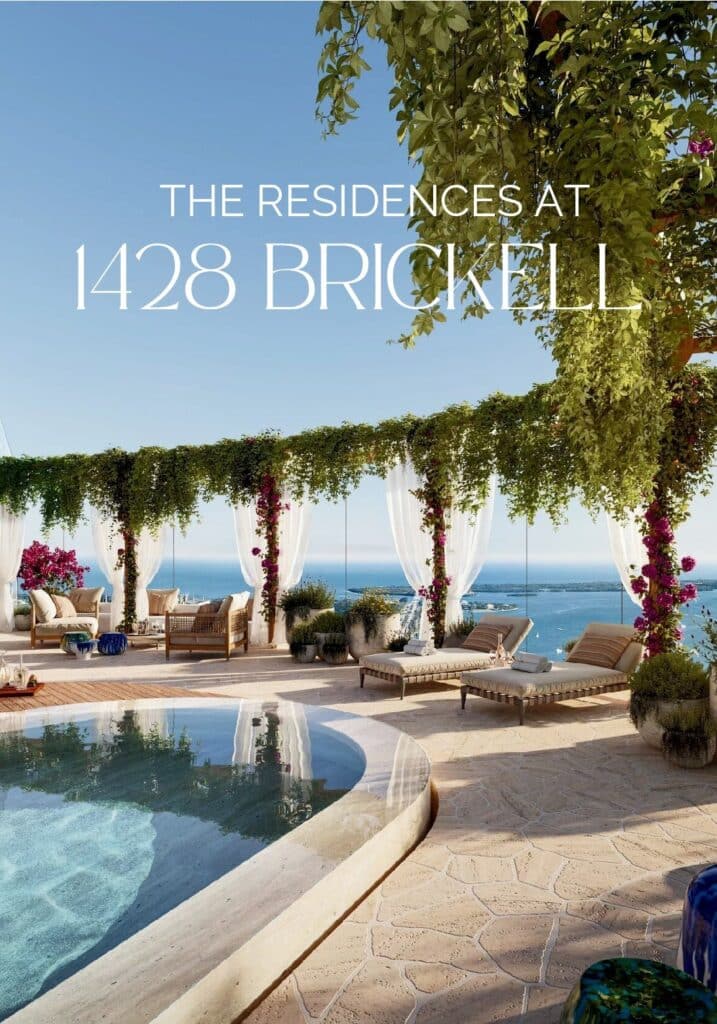

It’s no coincidence that so many companies and startups are moving their offices to this city, and this is not just a passing trend. It is redefining entire areas like Brickell and Downtown, which have evolved from mere business hubs into vibrant zones where people live, work, and enjoy life.

Slowdown in Housing Inventory Demand: What Does It Mean for You?

Another key trend is the slowdown in inventory.

In May 2024, the inventory of single-family homes in Miami-Dade was just 2.7 months, compared to 1.8 months in May 2022. This decrease in inventory reflects that demand continues to outpace supply, which not only keeps prices on the rise but also creates a competitive environment where buyers must act quickly.

You might wonder: Is this a risk or an opportunity?

What we are seeing is a stabilization after years of uncontrolled growth. And in my experience, this can be positive for strategic investors who know how and where to find the best opportunities.

Finally, it’s essential to consider government policies and interest rate fluctuations. Both factors can significantly influence the direction of the market.

At Waallss, we keep a close eye on these changes to ensure our clients are always one step ahead.

Key Areas to Invest in Miami in 2024

One of the questions I get asked the most is: ‘Where is the best place to invest in Miami?‘ And while the answer depends on many factors, there are certain areas that, in my experience, stand out above the rest.

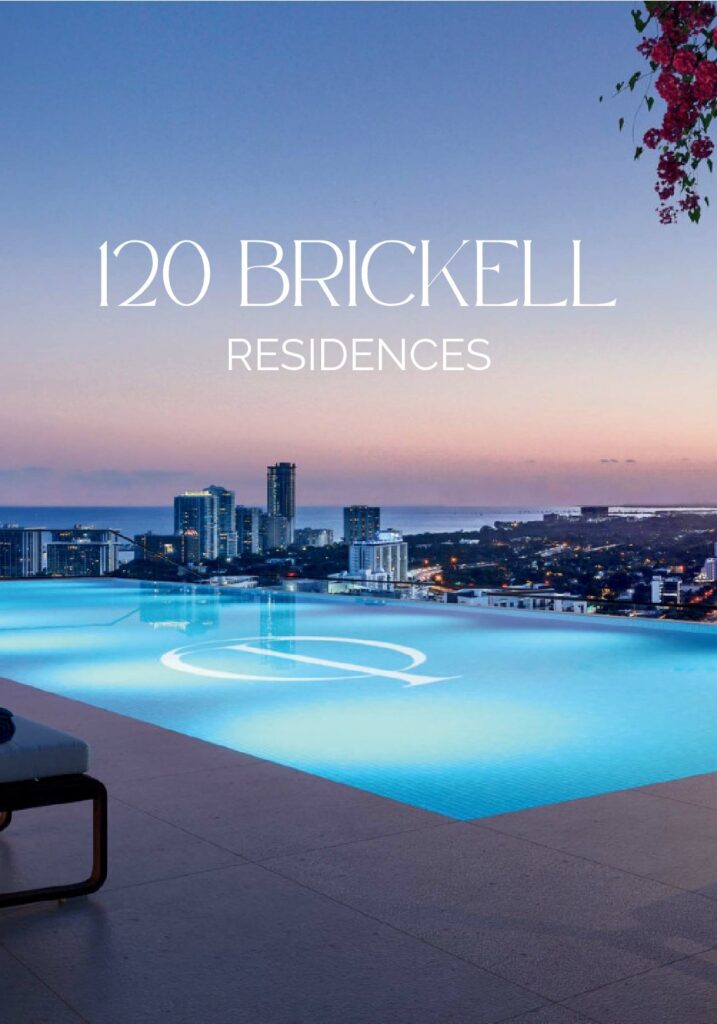

For investors, Brickell represents stability and long-term appreciation potential.

The average price of a condo in this area is around $800,000, but I have seen some properties easily exceed a million, especially those with views of Biscayne Bay. Rents in Brickell are also lucrative, thanks to the constant influx of young professionals and expatriates looking for a place in the heart of Miami.

My recommendation for 2024: Brickell remains a solid bet, especially if you are looking for properties with high rental returns.

Downtown Miami: Revitalization and Exponential Growth

Currently, the average price of a property in Downtown is in the range of $600,000, with variations depending on proximity to the water and views.

Unlike Brickell, Downtown offers more diversified options, from modern apartments to industrial lofts.

If you are an investor looking to be at the epicenter of Miami’s urban renaissance, Downtown could be the ideal option for you.

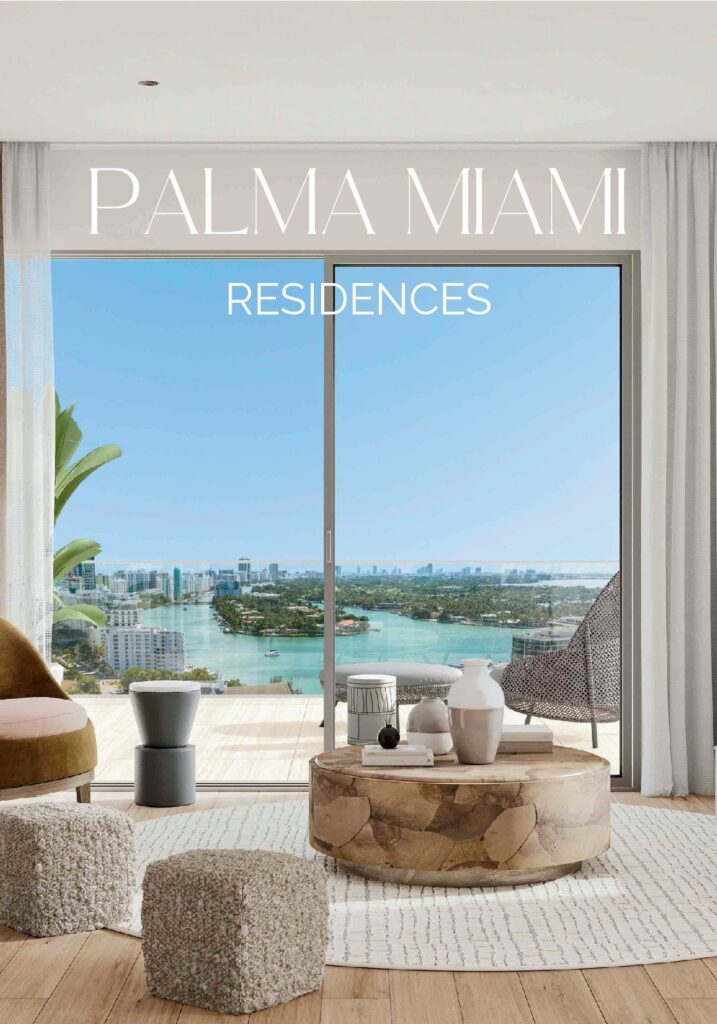

Miami Beach will always be one of the jewels of South Florida. With its world-renowned white sand beaches, luxury hotels, and vibrant nightlife, it remains a top destination for both tourists and investors.

The average price of a property in Miami Beach easily exceeds a million dollars, especially those located on the waterfront. It is an ideal area for short-term rentals, something I’ve seen many of my clients leverage to generate solid passive income.

List of Best Areas to Invest in Miami

Factors to Consider When Choosing an Area to Invest

Not all areas offer the same potential for appreciation or profitability. Here, I share the key factors you should consider when evaluating where to invest in this dynamic city.

Market Demand: Understanding Local Supply and Demand

One of the most crucial factors when investing is understanding the demand in the area.

Miami continues to attract new residents, from young professionals to retirees and international families. Areas like Brickell and Downtown have consistently high demand due to their combination of job opportunities and urban lifestyle. In contrast, places like Coconut Grove attract a more specific niche looking for tranquility and character.

Before making a decision, it is essential to assess who the potential buyers or tenants are in each area and how that demand is projected in the future.

Property Type: What Best Fits Your Investment Strategy?

The choice of property type depends on your investment strategy.

For example, if you are looking for stable long-term income, a residential rental in areas like Aventura or Coral Gables could be ideal. On the other hand, those interested in capitalizing on the tourist market may consider vacation rentals in Miami Beach or Sunny Isles, where short-term rentals are more profitable.

Each type of property has its pros and cons, and it is important to align your choice with your financial goals.

Connectivity and Accessibility

Ease of access and connectivity are factors that can significantly increase a property’s value.

In Miami, proximity to major highways like I-95, 836, and 195, as well as closeness to public transportation hubs, play a crucial role.

For example, the development of the Brightline train station in Aventura has increased the area’s appeal.

Well-connected areas not only make life easier for their residents but also tend to appreciate in value more quickly.

Appreciation: What is the Area's Growth Potential?

A good investor is always looking ahead, seeking not only the current value of a property but also its growth potential.

In Miami, areas like Edgewater and Wynwood have shown impressive growth in recent years due to urban expansion and cultural revitalization.

Assessing projected appreciation is essential to maximize return on investment. This involves researching future developments, such as new commercial, residential, or infrastructure projects, that could drive the area’s growth.

Betting on an area with high appreciation potential is key to securing good long-term profitability.

Entry Cost and Return on Investment

Last but not least is the entry cost and the potential return on investment (ROI).

The entry cost not only includes the purchase price but also additional expenses such as taxes, insurance, maintenance, and potential renovations. For example, while Brickell may have a higher entry cost, the ROI can also be significant due to the high demand for rentals in the area.

Invest with Confidence in Miami

My team at Waallss and I are here to offer you the personalized approach you need. With years of experience in the Miami real estate market and a deep understanding of its trends and dynamics, our goal is to help you make informed and strategic decisions. From choosing the right area to finding the perfect property that aligns with your goals, we are committed to your success.

Whether you are looking for your first investment, considering a commercial development, or simply need a better understanding of the current landscape, we are here to support you. I invite you to schedule a personalized consultation with me. Together, we can explore your options, answer your questions, and design an investment strategy that brings you closer to your goals.

Fill out the form below to book your appointment, and let’s start building a successful future in the Miami real estate market.